Table of Content

A banker can help you obtain a Loan Estimate without completing a full loan application. If you do, lenders will then take into account your credit score, income and current DTI to determine whether or not you qualify and your interest rate. Make sure the specific terms of the loan your lender is offering makes sense for your budget.

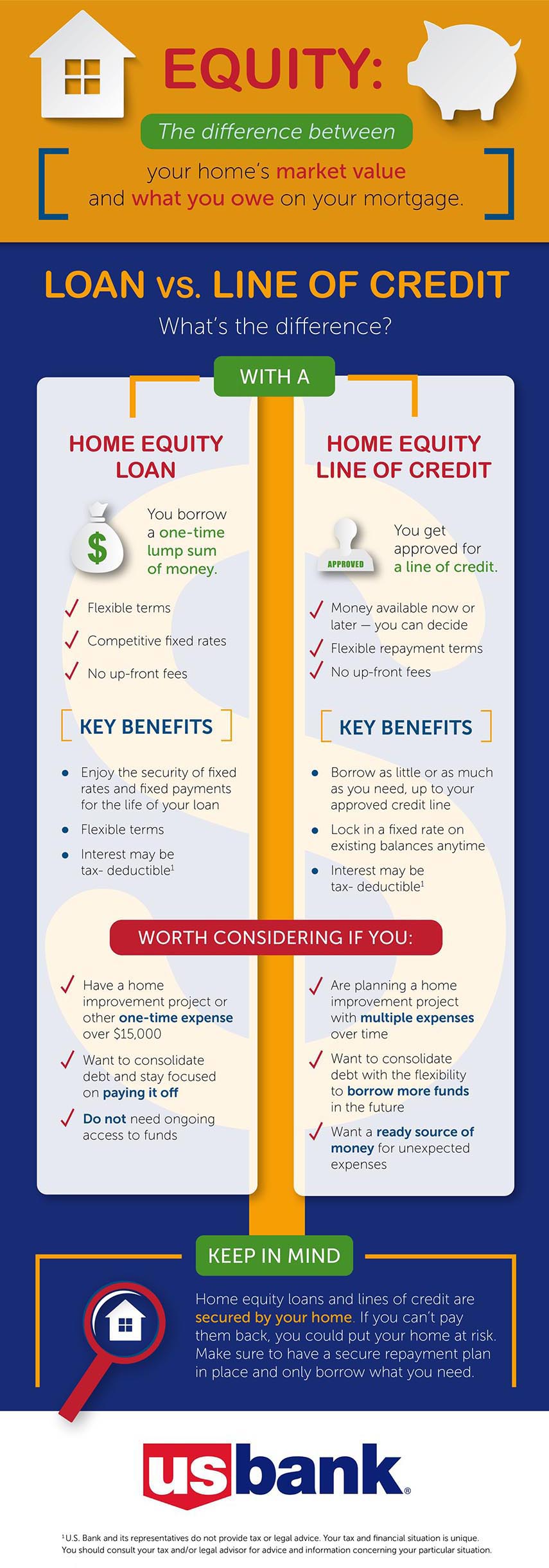

The average 15-year fixed-mortgage rate is 6.00 percent, up 9 basis points over the last seven days. Any way you look at it, $9,422 is a lot of money to invest in the future or put away in an emergency savings account. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. A home equity loan allows you to borrow against the equity you’ve built up in your home, with the property serving as collateral. Amplify Credit Union provides fee-free banking and award-winning lending throughout Texas. And with members in all 50 states and worldwide, Amplify is here with the financial services you need no matter where life's journey takes you.

Pros and cons of a home equity loan

Like many Americans, you may have built up enough equity in your home that you could now make it work for you by taking out a home equity loan. Personal loans have a simpler and faster application process, and more flexible loan amounts, than home equity loans. When you take out a home equity loan, you are borrowing against the value of your home. That means that if you default on the loan, the lender has the right to foreclose and sell the home to recoup their loss. Home equity loans are commonly referred to as a second mortgage or second lien because they are in the second position to the primary mortgage.

We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next. You’ll have to pay the entire outstanding balance at once if you sell your home. Most homeowners use proceeds earned from the sale to cover the balance. But if there’s a shortfall, you will pay the difference out of pocket for the transaction to close. You can possibly deduct interest paid on the loan if the proceeds are used for home improvements.

Risks

In fact, According to a study done by Corelogic, the average home equity gained between Q and Q is $60K. For example, if your home is worth $450,000 and you owe $250,000 on your loan, you would refinance for the entire $450,000, rather than the amount you owe on your mortgage. Your new cash-out refinance home loan would replace your existing mortgage, and then offer you a portion of the equity you built (in this case $200,000) as a cash payout. One potential downside of a home equity loan is that if your property value goes down for any reason, you could end up underwater on your loan. This happens when the balance of your loan becomes higher than the value of your home.

Negative equity -- or being "underwater" or "upside-down" on your mortgage -- happens when you owe more on your mortgage than what your house is actually worth. If you take out a home equity loan and haven’t paid off your first mortgage yet, you’ll have to make payments on both loans at the same time. Bank of America offers fixed- and adjustable-rate conventional and jumbo mortgages , FHA loans and the Affordable Solution Mortgage, which requires just 3% down and no private mortgage insurance.

Will taking out a home equity loan hurt my credit score?

This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. That's a significant benefit for anyone looking for financing at a time when it's uncertain how much higher rates will rise.

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Tapping your home equity can be a convenient, low-cost way to borrow large sums at favorable interest rates to pay for home repairs or debt consolidation. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

$50 Loan Instant Apps: Overcome Money Difficulties

LendingTree does not include all lenders, savings products, or loan options available in the marketplace. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . If it doesn’t seem feasible, you may want to have your child take out a student loan, as they will have many more income-making years to repay the debt. Bankrate.com is an independent, advertising-supported publisher and comparison service.

A home equity loan could seem like a viable option, but maybe you would rather not take on more debt. Fortunately, there’s another solution to get the equity out of your home. Finding the best home equity loan can save you thousands of dollars or more. Different lenders have different loan programs, and fee structures can vary dramatically. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Additionally, the lender will often order an appraisal, which they’ll use to gauge your home’s value and how much equity you can borrow. To tap into your home’s equity through one of these options, you’ll need to go through a process similar to obtaining a mortgage. You can apply through a bank, credit union, online lender or another financial institution that offers these home equity products. You'll also want to be sure that this type of loan makes sense before you borrow. Is it a better fit for your needs than a simple credit card account or anunsecured loan? These other options might come with higher interest rates, but you could still come out ahead by avoiding the closing costs of a home equity loan.

If it feels as though you're caught on a hamster wheel of debt and can't get off, debt consolidation may be the answer you're looking for. The goal of consolidation is to secure a lower interest rate and save money. Maurie Backman writes about current events affecting small businesses for The Ascent and The Motley Fool. Liens or any interest secured on the property by MV Realty must be paid off and removed as a condition to close.

Part of how much you qualify for also depends on your credit profile. Some lenders will loan up to 85% or even more of a borrower’s equity if you have an excellent credit score and a strong financial profile. Home equity loan rates are usually fixed, which means your payments will stay the same throughout the life of the loan. If you’re approved, the lender will create a second mortgage and cut you a check for the full loan amount. You can then use this lump sum how you wish and will repay it in equal installments with interest over time. This can be a good option if you know exactly how much you need to borrow.